Asset Liquidity

Convert precious metal claims into digitized assets.

Immutable Ledger

A permanent, tamper-proof digital ledger ensures integrity.

Transparent Ownership

"Smart Certificates" authenticate sale and transfer.

Proven Technology

Powered by state-of-the-art distributed ledger technology.

Asset-Backed Smart Securities

Orebits provides asset-digitization services that are managed on a distributed ledger via smart contracts called "Smart Certs". By digitizing ownership records of recoverable precious metal reserves into digital certificates called Orebits, reserve owners and peripheral investors are able to maximize their liquidity. The resulting increase in liquidity may enable the Smart Certs to be utilized for financing, collateral, private transactions or simply as a line item on his/her balance sheet.

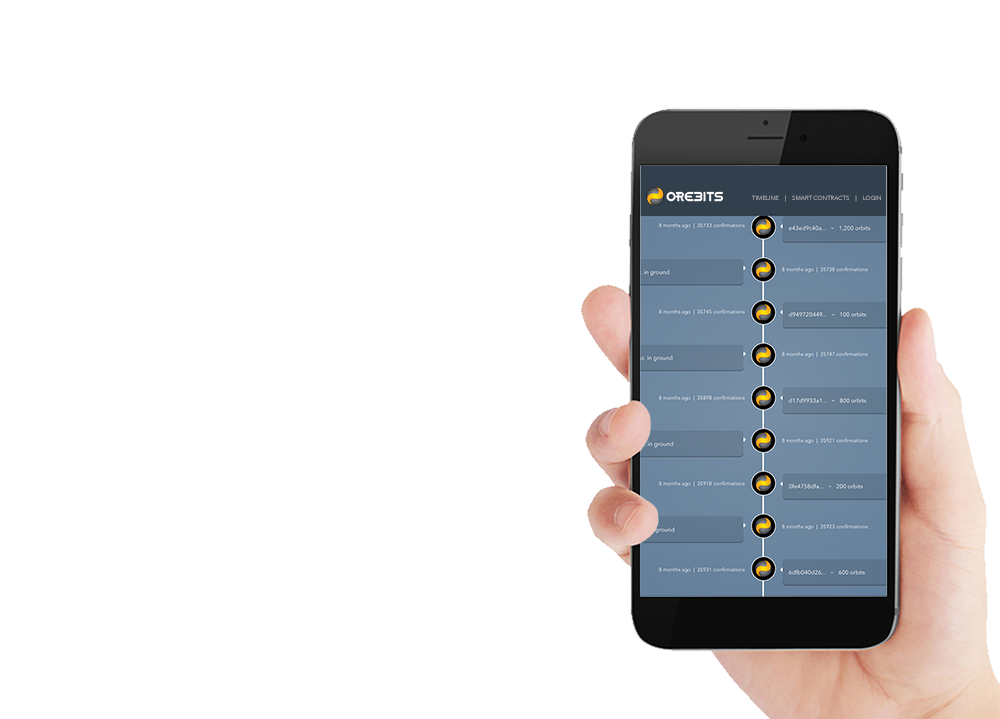

Orebits Technology

The Orebits Corp. platform uses state-of-the-art distributed ledger and smart contract technology to create a new digital asset class—one made possible by digitizing claims to precious metal and mineral reserves—transforming illiquid commodity reserves into fungible digital assets. For the record, distributed ledger technology is an ideal platform for asset digitization because it provides an immutable record of the origination and provenance of these new assets, while creating a tamper-proof repository for all documentation backing the issuance. Similarly, the distributed ledger platform provides a shared backend system for multiple, trusted parties that need to share data and logic in real time. It is a decentralized database that replicates and executes application logic in the form of smart contracts.

Learn More

Transferable Liquidity

Extreme volatility in today's financial markets has brought greater attention to the value of commodities and to the universal exchange rate of gold specifically. Despite this, today's stakeholders find themselves in a difficult situation. While they possess tenure to a highly coveted and valuable commodity, some reserves lack a market mechanism to fully monetize the holding. By digitizing mineral rights into Orebits Smart Certs, reserve owners are able to have liquidity prior to the reserves being mined, refined and sold in the marketplace. This provides an opportunity to collateralize illiquid assets for loans, private exchange or sale to investors seeking an attractive risk-to-return ratio or to simply better quantify the value of their asset for tax and financial reporting purposes.

Specifications and Risks

- Orebits are a digitized representation of the ownership of precious metal and mineral reserves.

- At the time of digitization, one Orebit is secured by 5 ounces of Gold reserves based on an 80% discount.

- Although this discount is quite conservative, the gold market is a volatile one that maintains large movements of value, operational costs, administrative expenses, and a variety of other tangible/intangible costs and variables.

- Orebits Corp. will review all required documentation on an annual basis to ensure Claim Owner compliance to the ADSA (Asset Digitization Service Agreement).

- Orebits Corp. will provide, upon request, any reported or discovered material changes to the Proven Gold Reserves Pool (for the digitization of Orebits) to Account Holders on the Orebits Ledger.

Frequently Asked Questions

Answers to some of the common questions we face from reserve owners and investors.

An Orebit is a digital representation, at an 80% discount, of unrefined Proven Gold Reserves.

Gold Orebits derive their value from the price of traded Gold. An Orebit, which has the value of one ounce of Gold, is a digital representation of five ounces of Proven Gold Reserves. Gold Orebits take this value from the LBMA AM daily fixing price.

Reserve owners in search of liquidity, digitize their Proven Gold Reserves, utilizing Smart Contract and Distributed Ledger technology to bring Orebits to the market.

Any Investor who desires exposure to the price movement of Gold, while enjoying the benefits of owning an asset on an immutable Distributed Ledger should consider investing in Orebits.

Orebits Corp. provides exposure to the price movement of Gold while limiting the expense of traditional Gold investments. Competing investments such as Futures or Physical Gold require attention to details such as Margin, Storage and Insurance. Orebits do not require additional financial considerations and are therefore a reasonable alternative to currently available methods of investing in Gold.

Yes, all Gold Orebits are fungible.

To invest in Orebits, contact an Orebits Corp. Program Manager and request an account on the Distributed Ledger.

Orebits are a representation of unrefined Proven Gold Reserves that the reserve owner has digitized. We do not consider them a Derivative. However, we believe that the holders of Orebits will be able to create Derivative products from them.

Orebits Ledger LLC is the Special Purpose Vehicle (SPV) where all the UCC-type liens on the Proven Gold Reserves are placed and held as collateral for the purpose of digitization into Orebits.

Orebits Corp. is a Delaware LLC service provider that manages the Orebits Ledger LLC SPV.

The digitization of Orebits takes the form of a 10-year renewable Asset Digitization Service Agreement (ADSA) that allows for continued digitization of Orebits and market liquidity.

In the case of insolvency, Orebits Ledger LLC has the right to claim all Proven Gold Reserves that have been pledged to the pool to allow for the continued backing of all Orebits that are in the market.

At the end of the 10-year period the owner of the Proven Gold Reserves will return the original amount of digitized Orebits to the SPV and the SPV will release all claims back to the owner.

Orebits can be transacted on the Orebits Corp. platform by establishing an account on the Distributed Ledger.